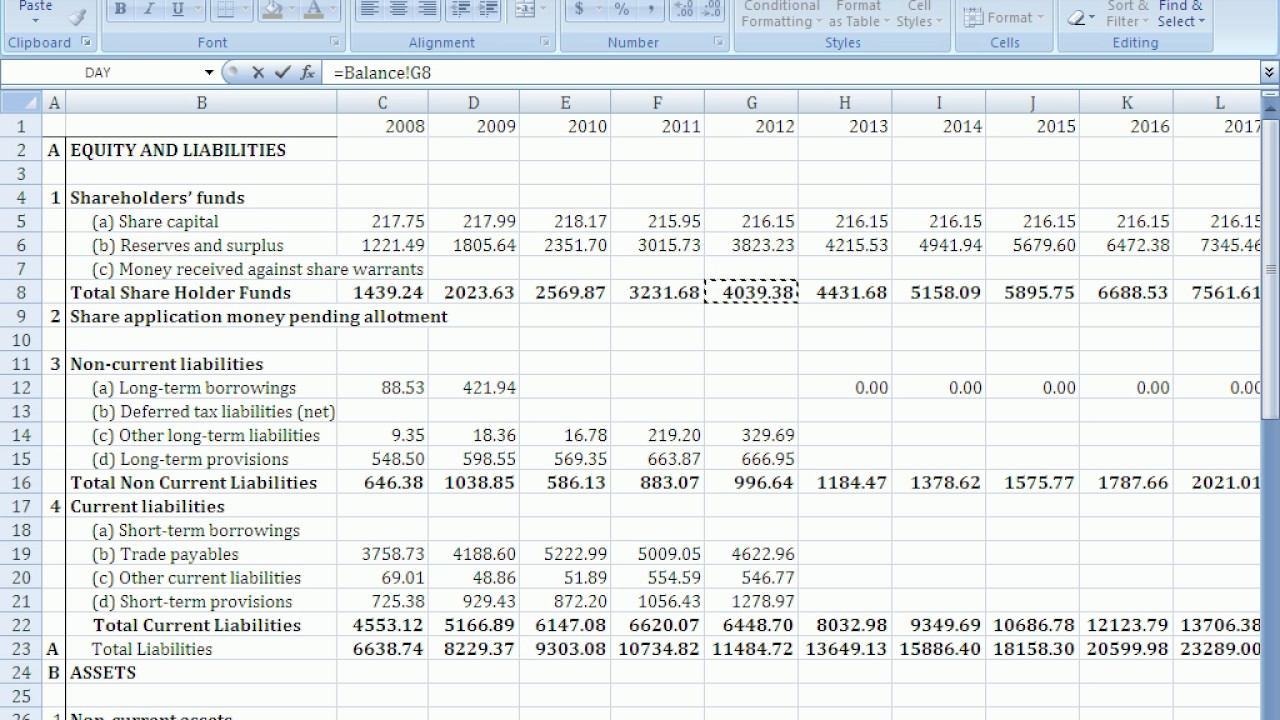

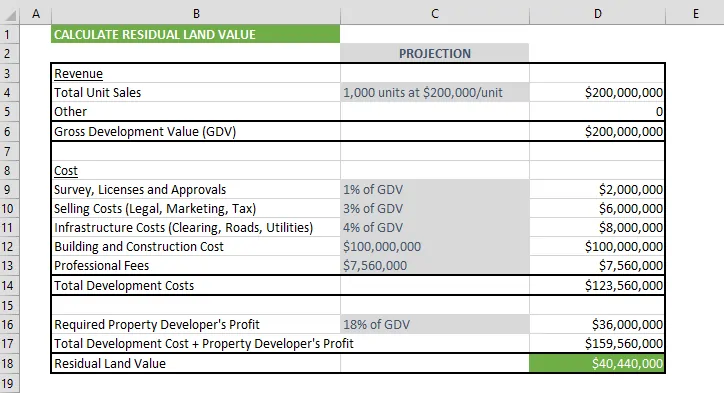

As can be seen below this valuation comes out to 4964 per share. Based on the residual valuation method the above implies that a developer can pay 37 million GST for the land and pay all costs required to complete the development with an expected return of 08m being 20.

The Residual Method 1 Introduction This Method Is

Contents of valuation report 820-821 Income or profit method of valuation 822 Valuation by residual method 823-825 823.

. The comparative method is considered to be one of the most defensive is approaches in order to calculate the residual value. Here residual means in excess of any opportunity costs measured relative to the book value of shareholders equity. This method is applicable where the building is old the.

In addition to the inputs used in our first example we will use Cokes 10 year average ROE of 307 and a 3 growth rate to reflect Coke growing alongside global GDP. F Development Potential The usage of every property is not. This method is also commonly employed by valuers alongside the comparable method.

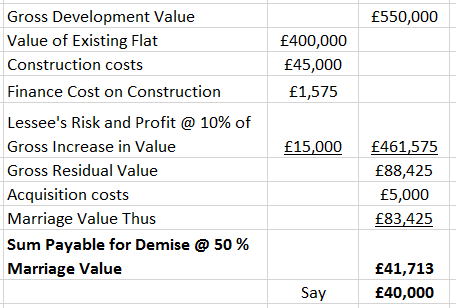

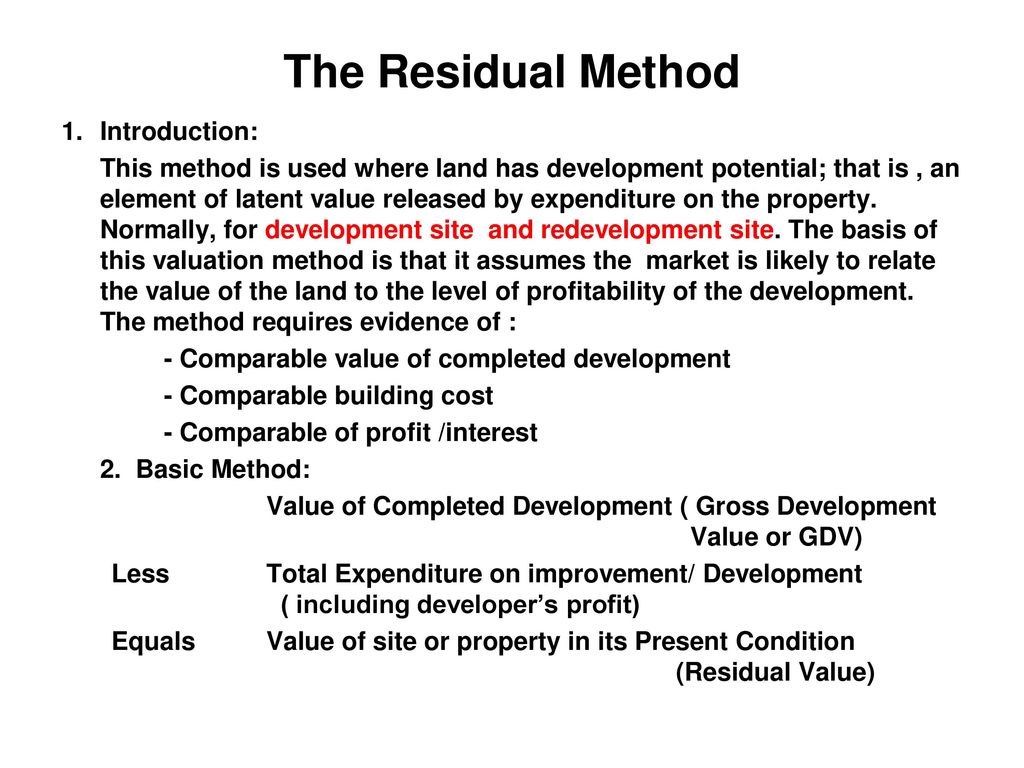

Residual income valuation also known as residual income model or residual income method is an equity valuation method that is based on the idea that the value of a companys stock equals the present value of future residual incomes discounted at the a. The best-case scenario of the residual method is directly related to the location of the land and existing planning legislation where the estimator through the residual method selects the optimal use. The residual approach starts with a notional value the gross development value GDV from similar projects and less the development cost and also the profit of the developer the residual value residuum.

A residual valuation is a very sensitive topic with slight variations in its different elements such as rent initial yield construction costs finance rate and building period. Continuing our example with Coke we will conduct a valuation using the single-stage residual income method. Because of this this method is regarded as one of the last resort.

The residual method is a hybrid of basic valuation approaches. Define Property residual method of valuation. The residual stress value was calculated according to the stress release principle.

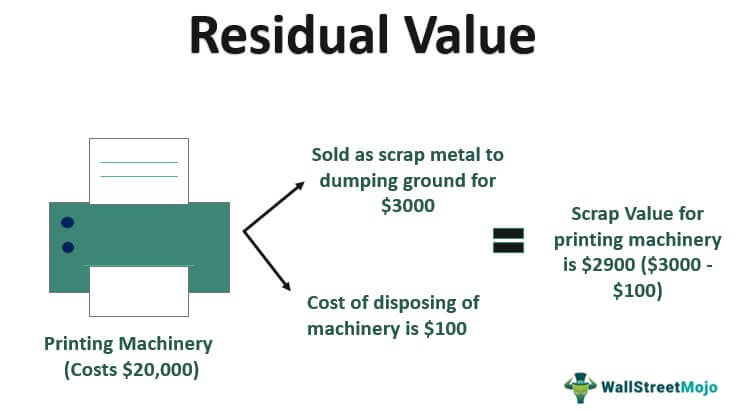

As the name suggests in this method the residual value is calculated by comparing with the residual value of comparable assets. Residual income is calculated as net income minus a deduction for the cost of equity capital. In this article well walk through several examples that will show you how the residual technique is used in commercial real estate valuation.

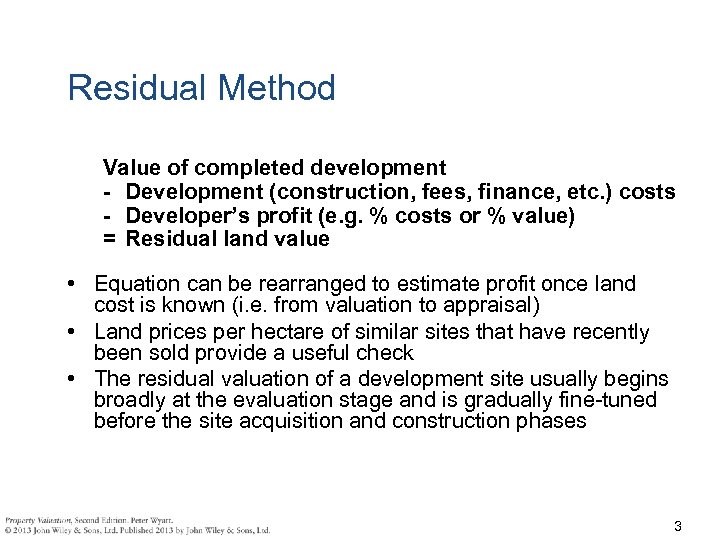

For commercial properties the. The Residual Method is adopted in the valuation of development property. This may be of bare land which is to be developed or redeveloped with entirely new buildings or of land with existing buildings which are to be altered and improved an exercise commonly termed refurbishment.

A number of methods including classical comparative. Ideally they will be able to draw on Level 2 and. The residual method is the preferred method of valuation in the UK for assessing the value of development land and development projects.

Having a robust understanding of the five valuation methods and when they should be applied will help candidates to meet the requirements of the Valuation competency. Both the income stream for the estimated useful life of the building and the reversionary interest in the land are discounted to present worth. The residual method is applied for developing land or projects to estimate the value of an undeveloped land.

In property development circles the residual method of valuation is an essential valuation tool for any aspiring investor as it helps. Residual income valuation RIV. Means that at the expiration of the term of the lease even though the building may have little value the land will have a reversionary value.

The residual method calculates the maximum value of an unfinished plot since it has been theoretically fully and optimally developed. The deduction called the equity charge is equal to equity capital multiplied by the required rate of return on equity the cost of equity capital in percent. It is used when there are no comparable market prices available.

The strain flowers were pasted at the position measured by the original X-ray diffraction method. What is Residual Income Valuation. These methods are known as residual techniques and can be used to estimate property value when either the value of the land or the value of the improvements is known.

2 Comparables method. Qualifications of valuer. Combination of income and cost appr oach is used.

Also residual income model and residual income method RIM is an approach to equity valuation that formally accounts for the cost of equity capital. It is also often used to value developments in the course of construction. Residual income RI is then the income generated by a firm after.

Economic value added EVA is a commercial implementation of the residual income concept. To apply the residual method candidates need to first assess the development potential of the land ie. The main focus of the valuation is to address and justify the concept of economic value.

Explore the subscription options. For the correct determina tion of. Then the blind hole with a hole diameter of 15 mm and a depth of 20 mm was drilled using a drilling device and the corresponding strain value was measured.

Accountancy treatment 826 Notifiable transactions 827 Connected transactions 828 Date and cost of original acquisition 829 Effective date. These assets are the one which is traded in an organized market. The residual value of a fixed asset is an estimate of how much it will be worth at the end of its lease or at the end of its.

Land Residual Value GRV Build Cost Project margin 85m 40m 08m Residual land value 37 million GST.

9 Accuracy And Bias Of Residual Income Valuation Model Under Download Table

Pdf Residual Method Used For Commercial Real Estate Valuation And Its Sensitivity

Valuing Roof Spaces For Development Peter Barry

Residual Value Definition Example Calculate Residual Value

Residual Operating Income Model Youtube

Lecture 9b Valuation 2 Residual Income Model Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Residual Value Methods And Assumptions Download Table

How To Calculate The Residual Land Value Efinancialmodels

Development Appraisal Residual Method Residual Method Value

Approaches Methods And Techniques Of Property Valuation Download Table

Pdf Residual Method Used For Commercial Real Estate Valuation And Its Sensitivity

The Residual Method Introduction Ppt Download

Development Appraisal Ppt Video Online Download

Residual Method Of Valuation For Land Development Appraisals

Pdf Residual Method Fara Nizan Academia Edu

Residual Income Method A Great Way To Estimate Intrinsic Value Of Companies Getmoneyrich